Cash Flow for Professional Service Firms – A Three Part Blog Series

Part Two – Trends Driving Change in Accounts Receivable Performance for Professional Service Firms

In Part One of this Blog we revealed the two main causes that underpinned professional service firms having poor accounts receivable metrics. Including the reasons why, on average, firms expect to be paid in 14 days, but it is actually taking 50 or more days to collect their fees.

In Part Two, we move on from historical observations to looking at a couple of modern themes that will make living with inefficient accounts receivable much more difficult.

Firstly, let’s leap forward 15 years. That’s a useful amount of time as it’s when current young professionals (in 2021) will have advanced to be the industry leaders.

Do you think those younger professionals will find accounting or law firms that operate much as they do now? Or do you think technology will have effected dramatic changes? Will machine learning and task automation have transformed workforces? Will clients still be charged in the same way?

Let’s consider the impact that two themes — new technology, and changes in professional service business models — have on the firms of the future and in turn what it all means for accounts receivable.

Technology

Change driven by technology is well underway. Just look to where the focus is with budgets and spending. Gartner reports that lawyers’ budgets for technology will increase threefold from 2020 levels by just 2025. Professional service firm’s employees skillsets are also changing rapidly. In just three years it is thought that within large legal departments, 20% of the generalist lawyers will be replaced with non-lawyer staff – many of those are expected to be the technology support team.

In the accounting industry, technology has also seen huge numbers of manual processes and analog tools converted to digital solutions. Think about how many payment solutions and cloud accounting software applications exist today. Your clients are leading the digital charge using blockchain solutions (with or without a crypto currency transaction) to add efficiency and data security to business processes.

Across all industries, including professional services, the advent of ‘Open Banking’ is affecting the speed and quality of payment experiences. Whilst still under pilot in New Zealand, the Open Banking use cases are exploding in Australia. It’s impossible to think that in fifteen years’ time our banking transactions: deposits, payments and investment experiences will operate as they do now.

Business Models

“Time is money” has been both a catch-cry and a business model for professional services since… well always. However, intelligent tech and automation now allow any professional service firm to provide more accurate and faster solutions to their clients, without any increase in head-count.

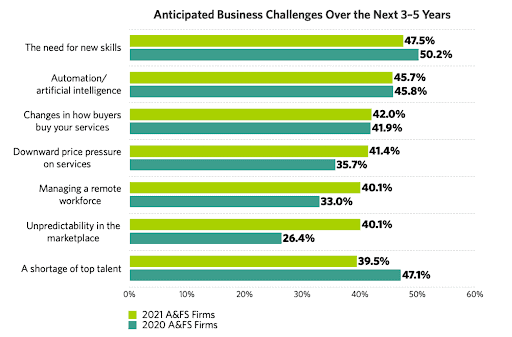

Clients are smart though. They know the new efficiencies their advisors enjoy and expect to be paying less. The Hinge survey of Accounting and Professional Service firms strongly indicates the growing (downward) pressure on fees.

In response, it’s inevitable that the professional service landscape will see less hourly pricing and:

• More Subscription Pricing for predictable recurring & compliance types of work.

• More Fixed Pricing using digital efficiencies to retain margin while decreasing delivery costs of bespoke project work.

• More Value Pricing with pricing linked to outcome rather than hours.

What does all this mean for our small part of the sandpit: accounts receivable?

In Part One we mentioned an elderly doyen of the accounting industry who offered clients two ways to pay: kneecaps intact, or not. In the not-too-distant future there will still only be two ways to pay:

Paid In Full

Regardless of how the professional service firm chooses to charge (Subscription/Value/Fixed Hourly), clients will pay the invoice tendered in full and exactly on time. A digital transfer for payment will be made in full upon an agreed date or milestone. Of course there will be dozens of ways to pay in full – Direct Debit, Crypto, Credit Card – however the fees will be “taken” (as agreed in the engagement letter/terms of trade) as a lump sum. Why would it be any other way?

Paid in Full – Financed

The only exception to payment in Full is when a client pays in full by financing their fees. That may be because they need to pay that way or prefer to pay that way. Regardless, it will have been agreed in advance and means the professional service firm is still paid in full, with the client paying in instalments. Why would it be any other way?

In the final part of this blog series we explore how today’s professional firms can make the transition from the current environment, where fees are generally paid late, to a world where all firms are paid in full and on time.

If you would like to get in touch with us, use the button below and we’ll be in touch shortly.